Sales Tax Calculator 2025 Arkansas - Arkansas State Sales Tax Rate 2025 Kevyn Merilyn, If you make $70,000 a year living in delaware you will be taxed $11,042. Showing 1 to 791 of 791 entries. Free calculator to find the sales tax amount/rate, before tax.

Arkansas State Sales Tax Rate 2025 Kevyn Merilyn, If you make $70,000 a year living in delaware you will be taxed $11,042. Showing 1 to 791 of 791 entries.

Sales Tax Calculator 2025 Arkansas. Arkansas has a 6.5% statewide sales. The springdale, arkansas, general sales tax rate is 6.5%.

Sales Tax Calculator for All U.S. Cities Casaplorer, If you make $70,000 a year living in delaware you will be taxed $11,042. The springdale, arkansas, general sales tax rate is 6.5%.

How to Calculate Sales Tax in Excel Tutorial YouTube, Sales tax is a tax paid to a governing body. Additional sales tax is then added on depending on location by local government.

Sales Tax Calculator CodexCoach, Discover our free online 2025 us sales tax calculator specifically for , arkansas residents. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the u.s.

2025 arkansas state sales tax. Zinc, ar sales tax rate.

Sales Tax Calculator by Zip Code [2025] Calculator Adam, Municipal governments in arkansas are allowed to collect local sales taxes, so the total sales tax rate varies between cities,. There is also 416 out of 741 zip codes.

The Best Sales Tax Calculator In 2025, Arkansas has a statewide sales tax of 6.5%. Local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%.

Alabama Sales Tax Calculator 2025 State, County & Local Rates, Depending on the zipcode, the sales tax rate of springdale may vary from 9.75% to 10.75%. Other 2025 sales tax fact for arkansas as of 2025, there is 320 out of 630 cities in arkansas that charge city sales tax for a ratio of 50.794%.

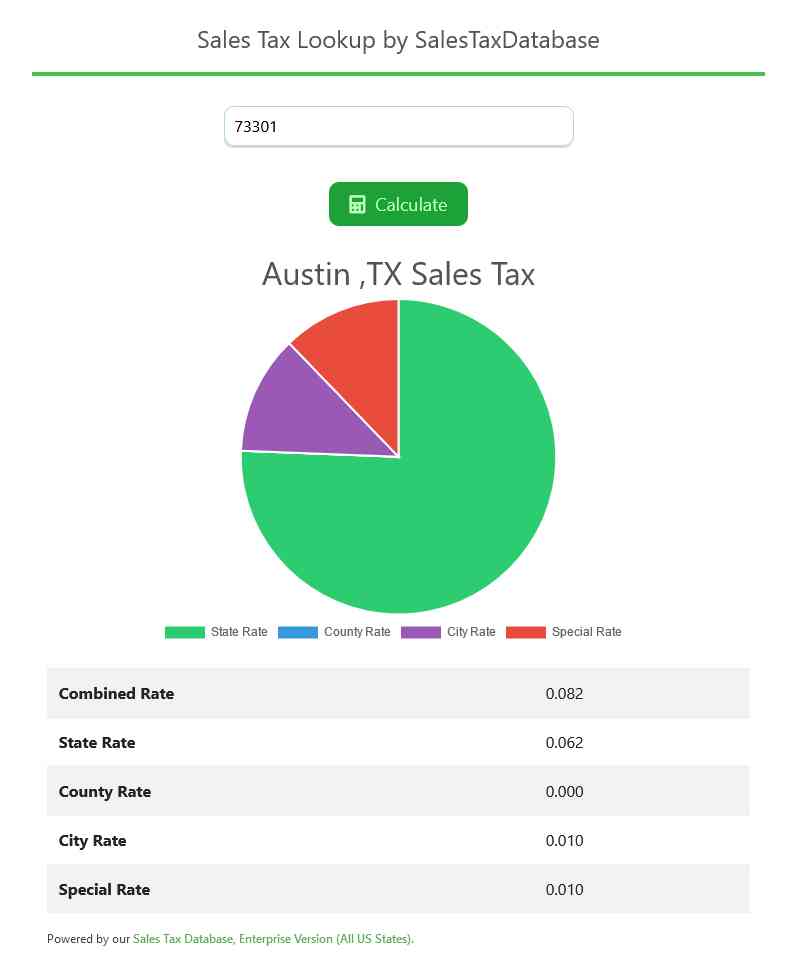

Sales Tax Database, The state sales tax rate in arkansas is 6.5%. Average local + state sales tax.

Sales tax calculator, The 72042, de witt, arkansas, general sales tax rate is 11%. Depending on the zipcode, the sales tax rate of springdale may vary from 9.75% to 10.75%.

How to Get Arkansas Sales Tax Permit A Comprehensive Guide, Then, identify the local sales tax rates, varying across counties, cities, and districts. If you make $70,000 a year living in delaware you will be taxed $11,042.